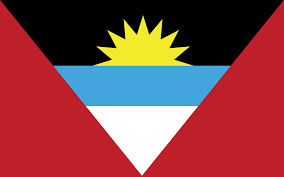

antigua-and-barbuda-used-car-import-rules-and-regulations

RESTRICTION IN NUMBER OF YEARS: NO LIMIT

SHIPPING PORTS: ST. JOHNS

Shipment Time: 25-35 DAYS

Shipping Schedule: MONTHLY

Shipping Line: NA

Inspection: NO INSPECTION REQUIRED

Import Duty will be imposed at rates of 0%, 5%, 10%, and 20%

The duties and taxes imposed on the export of used cars from Japan are determined based on the Customs Procedure Code (CPC) and the relevant Tariff Code. These include:

- A 15% VAT applied to the overall price of the vehicle intended for export from Japan.

- A maximum Customs Duty of up to 60%, which is contingent upon the CIF (Cost, Insurance, and Freight) value of the used Japanese vehicle.

- An Environmental Levy of $6000.

These calculations are crucial when exporting used Japanese cars and are influenced by specific codes and values associated with the customs and taxation process.

The process for customs declaration of used Japanese cars involves several steps:

- The Customs Declaration Form, known as a warrant, is created by the broker or importer using the invoice and Bill of Lading for the used Japanese vehicles.

- The warrant is submitted at the transit shed, where a valuation officer inspects the vehicle from Japan to verify its cost, as well as the quantity and type of refrigerant used.

- The refrigerant form is approved and documented at the National Ozone Office.

- Next, the Environmental Levy Form must be obtained from the Environmental Protection Unit. It’s important to note that the Environmental Levy may be waived depending on the age of the used vehicle from Japan.

- All the aforementioned documents are then submitted at the customs office for processing and the collection of applicable duties and taxes.

- After payment of the duties and taxes, the broker or importer takes the warrant to the Port Authority situated at the Deep Water Harbour for stamping.

- Finally, the stamped warrant is presented at the Deep Water Harbour Transit Shed, where a Customs Officer verifies the payments and stamps the documents. These stamped documents are then handed over to the port authority, which authorizes the release of the Japanese vehicle from the port.

he necessary documents for importing used cars from Japan into Zimbabwe include:

- Approved Refrigerant Form from the National Ozone Office

- Commercial Invoice

- Bill Of Lading

- Environmental Levy Form

- Title and Registration Certificate

- Insurance Policy and logbook indicating the ownership duration of the used Japanese vehicle

- Import license issued by the Ministry of Trade