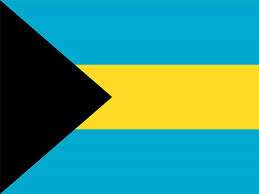

bahamas-used-car-import-rules-and-regulations

RESTRICTION NUMBER OF YEARS: 2014 YEARS AND ABOVE

PORTS: FREEPORT, GRAND BAHAMA

SHIPPING TIME: 25-40 DAYS

SHIPPING LINE: CNC JAPAN

SHIPPING SCHEDULE: MONTHLY

INSPECTION REQUIREMENT: NO INSPECTION REQUIRED

Customs duties are calculated based on the CIF (Cost, Insurance, and Freight) value of the vehicle, and the rates are as follows:

- If the car’s value is $10,000 or less, the duty imposed is 45%.

- For cars valued between $10,000 and $20,000, the duty imposed is 50%.

- If the car’s value exceeds $20,000, the duty imposed is 65%.

Additionally, there is an extra 7.5% VAT on the imported vehicle, with an exemption for temporarily imported vehicles. There is also a USD 200 Environmental Levy, a procedure fee equivalent to 1% of the FOB (Free On Board) price, and various other charges including storage fees, freight, insurance charges, and the landed cost.

These rates and charges are determined by the CIF value and the import status of the vehicle, impacting the overall cost of importing the vehicle.

Importation of left-hand drive vehicles from Japan is allowed, and there is no requirement for pre-shipment inspection. In the Bahamas, there is a limitation on the age of used Japanese cars, which should not exceed 4 years. For importing trailers and caravans, obtaining special permission is mandatory, and the vehicle must undergo inspection at the Road Traffic Department.

- A copy of your passport or driving license

- Import permit

- Inspection certificate

- Taxpayer Identification Number

- Bill of Lading

- Original Commercial Invoice

- A copy of the Title and Registration certificate

- Insurance Policy and logbook indicating the ownership duration of the used Japanese vehicle

- C-14 form if the shipping port is Nassau